Managing Finances with a New Baby: Tips & Budget Strategies. In today’s article, kienthucsannhi.com will explore with you in the most detailed and complete way. See now!

Understanding the Financial Impact of a New Baby

Welcome to the world of parenthood! As you embark on this incredible journey, one of the first realities you’ll face is the financial impact of bringing a new baby into your life. It’s not just about cute clothes and cuddly toys; it’s about a significant shift in your expenses and potentially your income. Let’s break down the key areas to consider.

Increased Expenses: The arrival of your little one will naturally bring an influx of new costs. Here’s a look at the most common expenses:

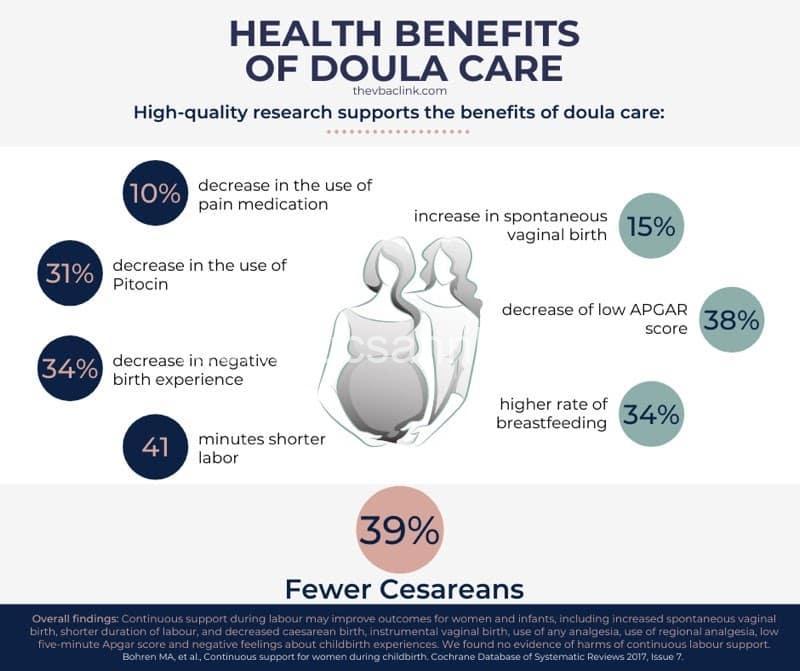

- Healthcare Costs: From prenatal care to delivery and postpartum care, healthcare expenses are a major factor.

- (Baby, Has, Healthcare)

- (Healthcare, Requires, Insurance)

- Housing Costs: You might need a larger home or renovations to accommodate a growing family.

- (Housing, Costs, Money)

- Childcare Costs: Daycare, babysitters, or nannies can significantly impact your budget.

- (Childcare, Costs, Money)

- Food Costs: Formula, baby food, and increased grocery bills can add up quickly.

- (Baby, Needs, Food)

- Clothing and Accessories: Diapers, wipes, clothes, and accessories are essential, and they can be surprisingly expensive.

- (Baby, Needs, Clothing)

- Toys and Educational Materials: As your baby grows, you’ll need to invest in toys and educational materials to support their development.

- (Baby, Needs, Toys)

Reduced Income: The arrival of a new baby can also impact your income, particularly for parents who take parental leave or adjust their work schedules.

- Parental Leave: While many countries offer parental leave, it’s often unpaid or partially paid, leading to a reduction in income.

- (Parental Leave, Affects, Income)

- Reduced Work Hours: One parent might need to reduce work hours or even stop working entirely to care for the baby.

- (Income, Can Be, Reduced)

- Career Changes: Some parents may decide to make career changes that offer more flexibility or reduced hours.

Prioritize Essential Expenses: It’s important to prioritize essential expenses, like housing, food, and healthcare, while keeping in mind long-term financial goals.

## Creating a Budget for Your New Family

With a new baby comes a new set of financial priorities. Building a realistic budget that accounts for your new expenses and potential income changes is essential for financial stability.

Track Spending: To create an effective budget, you need to understand where your money is going. Start by tracking your income and expenses for a month or two.

- Use budgeting apps: Many apps are available to help you track spending, categorize expenses, and create a budget plan.

- Use a spreadsheet: If you prefer a more manual approach, create a simple spreadsheet to track your income and expenses.

Prioritize Expenses: Once you have a clear picture of your spending, you can start prioritizing. Essential expenses like housing, food, and healthcare should be your top priority.

- Essential Expenses: Ensure you have enough income to cover these basic needs.

- Discretionary Expenses: Review your discretionary spending and look for areas where you can cut back.

Allocate Funds: Set aside funds for specific categories within your budget.

- Savings: Establish an emergency fund and consider saving for future goals like your child’s education.

- (Savings, Can Be, Increased)

- Childcare: Allocate funds for daycare, babysitters, or nannies if applicable.

- (Childcare, Costs, Money)

- Healthcare: Set aside funds for healthcare costs, including insurance premiums, doctor visits, and prescriptions.

- Baby Essentials: Allocate funds for diapers, wipes, clothes, and other baby necessities.

## Maximizing Your Income to Meet New Expenses

While managing expenses is important, increasing your income can also help you cope with the added financial burden of a new baby.

Utilize Parental Leave Benefits: If your country or employer offers parental leave, utilize this benefit to the fullest extent possible.

- Maximize Paid Leave: Take advantage of any paid leave offered to help maintain your income.

- Explore Alternative Income: During unpaid leave, consider part-time work, freelance opportunities, or online ventures to supplement your income.

Explore Flexible Work Options: If returning to work full-time isn’t feasible, consider flexible work arrangements to balance your work and family life.

- Work From Home: Explore options for remote work, which can offer greater flexibility and potentially reduce childcare costs.

- Part-Time Work: Consider reducing your hours or finding a part-time job that fits your schedule.

- Freelance Work: Explore freelance opportunities in your field or a related area.

Consider Side Hustles: Side hustles can provide an extra source of income, allowing you to manage expenses and save for future goals.

- Online Ventures: Explore online businesses, such as blogging, selling online courses, or starting an e-commerce store.

- Freelance Services: Offer freelance services like writing, editing, web design, or graphic design.

- Part-Time Jobs: Take on a part-time job in your spare time.

## Saving for the Future: College, Emergencies, and More

Saving for your child’s future is a vital part of financial planning for new parents.

College Savings Plan: Starting a college savings plan as early as possible will help ensure you have enough funds for your child’s education.

- 529 Plan: A 529 plan allows you to save for college expenses tax-free.

- Contribution: Begin contributing regularly to the plan even if it’s a small amount.

Emergency Fund: Building an emergency fund is crucial for unexpected expenses.

- Cover 3-6 Months of Expenses: Aim to save enough to cover 3 to 6 months of living expenses.

- Financial Buffer: This fund acts as a financial buffer for unexpected events like job loss, medical emergencies, or car repairs.

Long-Term Investment: Consider investing for long-term financial security.

- Stocks, Bonds, Mutual Funds: These options offer potential for growth over time.

- Consult a Financial Advisor: A financial advisor can help you create an investment plan tailored to your individual needs and risk tolerance.

Utilize Tax Benefits: Many tax benefits are available for families, including tax credits and deductions for childcare expenses, education costs, and medical expenses.

- Tax Specialist: Consult a tax specialist to learn about the tax benefits you qualify for and ensure you’re taking advantage of all available deductions.

## Minimizing Expenses for Baby Essentials

While baby essentials are necessary, there are ways to save money without compromising quality.

Shop Smart: Look for deals and discounts when buying baby essentials.

- Secondhand Options: Consider buying gently used clothing, toys, and equipment.

- Coupons and Discounts: Utilize coupons, discount codes, and promotional offers.

- Bulk Purchases: Buy items in bulk if possible to save on per-unit costs.

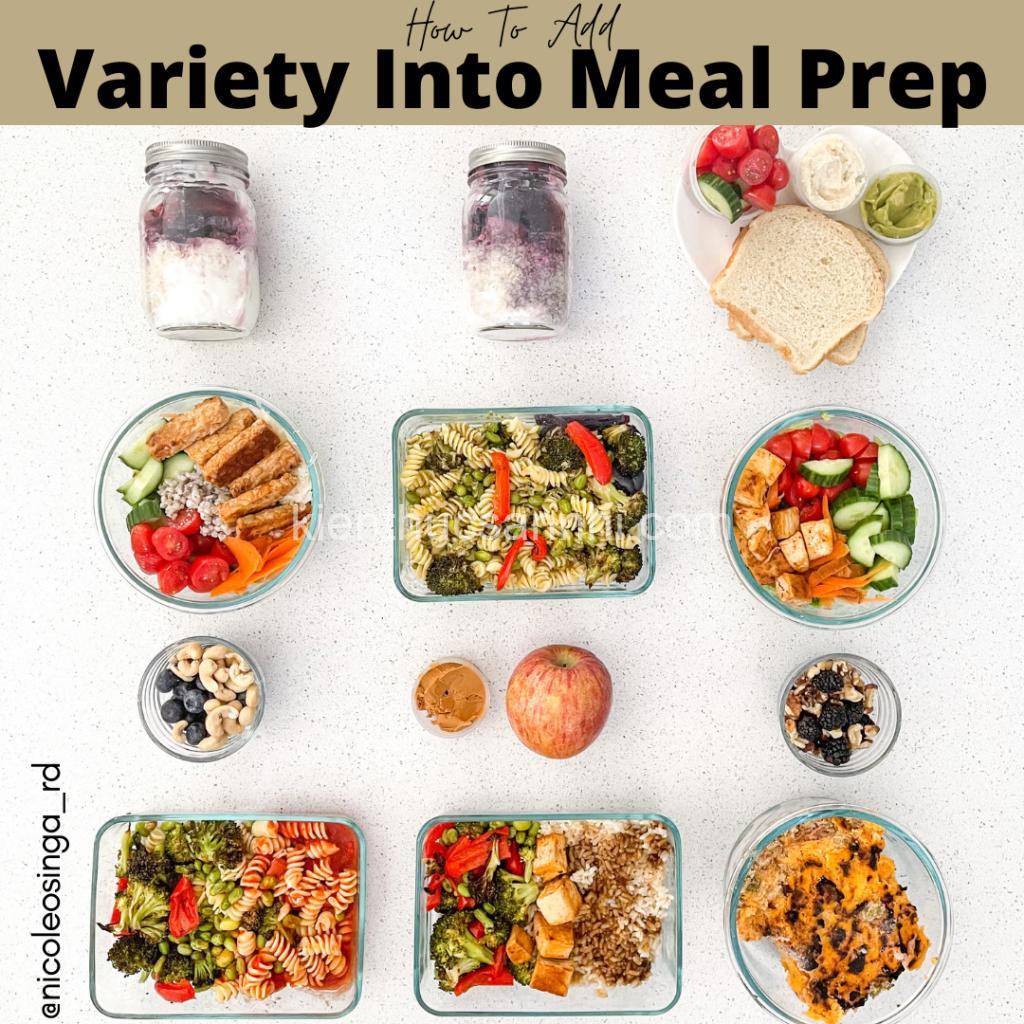

Cook at Home: Cooking at home is often a more cost-effective option than dining out.

- Meal Planning: Plan meals in advance to reduce impulse purchases and food waste.

- Cook in Bulk: Cook large batches of meals to freeze and reheat later.

Free Activities: Take advantage of free or low-cost activities for babies and families.

- Parks and Playgrounds: Enjoy outdoor time at parks and playgrounds.

- Library Story Time: Attend story time at your local library.

- Community Events: Look for free community events like concerts, festivals, or art fairs.

Utilize Community Resources: Connect with local community resources for support and savings opportunities.

- Parenting Classes: Attend free or low-cost parenting classes.

- Support Groups: Join a support group for new parents to share tips, advice, and resources.

- Local Charities: Explore local charities that offer resources for families in need.

## Seeking Professional Advice for Financial Planning

Navigating the financial landscape of parenthood can be complex. Seeking professional advice can provide valuable guidance and support.

Financial Advisor: A financial advisor specializing in family finances can offer personalized advice on managing debt, investing, and saving for your child’s future.

- Budgeting and Planning: They can help you create a budget that meets your family’s specific needs.

- Investment Strategies: They can recommend investment options for long-term financial goals.

- Tax Planning: They can help you minimize your tax liability and maximize deductions.

Tax Specialist: A tax specialist can help you understand the tax implications of having a child and identify any tax credits or deductions you qualify for.

- Tax Credits and Deductions: They can help you claim tax benefits for childcare expenses, education costs, and medical expenses.

- Tax Filing: They can assist you with preparing your tax returns and ensure you comply with all tax laws.

Insurance Agent: An insurance agent can review your existing insurance policies (life, health, disability) and adjust them to meet your family’s needs.

- Life Insurance: Consider life insurance to provide financial protection for your family in case of your death.

- Health Insurance: Ensure your family has adequate health insurance coverage.

- Disability Insurance: Consider disability insurance to protect your income if you become disabled.

## FAQs About Managing Finances with a New Baby

What are the biggest financial challenges new parents face?

The biggest financial challenges new parents face are increased expenses, potential income loss, and the need to save for their child’s future.

How can I create a realistic budget?

To create a realistic budget, you need to track your income and expenses, prioritize essential expenses, and allocate funds for different categories like savings, childcare, and healthcare.

What are some tips for maximizing income?

To maximize income, consider utilizing parental leave benefits fully, exploring flexible work options like work-from-home or freelance opportunities, and considering side hustles to supplement your income.

How can I save money on baby essentials?

To save money on baby essentials, shop smart by looking for deals and discounts, consider buying secondhand items, utilize coupons and discount codes, and cook at home.

How can I find financial resources for new parents?

Many resources are available for new parents, including free parenting classes, support groups, and local charities that offer assistance.

## Conclusion

Navigating the financial landscape of parenthood can be challenging, but it’s manageable with careful planning and resourcefulness. Remember to prioritize essential expenses, maximize income, and save for your child’s future. By utilizing these strategies and seeking professional advice when needed, you can ensure financial stability for your family.

For more helpful tips and resources, visit kienthucsannhi.com.

Michael David Smith is an animal lover and the founder of kienthucsannhi.com. He is passionate about providing accurate and reliable information to help users make informed decisions about their animal companions.

Connect with us! Let us know your thoughts and experiences by leaving a comment below. Share this article with other new parents who might find it helpful.